INTRODUCING AN INNOVATIVE BESPOKE CONCEPT IN PROPERTY INVESTING – “CO-LIVING”

✓ EARN DOUBLE THE YIELD COMPARED TO TRADITIONAL PROPERTY INVESTING

✓ EARN A MINIMUM OF $900 PER WEEK IN RENTAL INCOME COMPARED TO $450 A

WEEK FROM A TRADITIONAL PROPERTY INVESTMENT

✓ SUBSTANTIAL CASH FLOW POSITIVE INVESTMENT

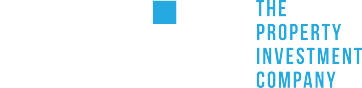

EXAMPLE OF A PURPOSE BUILT BESPOKE CO-LIVING HOME

Why Invest in a Co-Living Home?

There is a substantial shortage of good quality rental accommodation for Tenants to rent at an affordable price.

This rental shortage is being acerbated by First Time Home Buyers being unable to break into the Housing Market and being forced back into the rental market.

The Median Cost for a single person to rent is now in excess of $500 a week for shall we say less than attractive accommodation.

A Co-Living Home is a bespoke fully furnished home designed to accommodate 3 x separate individual Tenants affording the Investor 3 x separate income streams of a minimum of $300 a week each ($900 per week combined minimum total.)

So the advantage for a single person being part of a Co-Living Home is that they will be paying around $300 a week to live in a beautiful fully furnished home catering for all their needs and requirements.

But importantly for the investor, you will be receiving DOUBLE the average rental compared with a traditional investment property.

And if one of your Tenants does leave, you will still be receiving 2 x separate income streams whilst a replacement Tenant is being sourced.

Snapshot of Main Points of Attraction for Investing in a Co-Living Home:-

✓ The Co-Living Home has been specifically designed to house 3 independent Tenants.

✓ Anticipated minimum rental will be $300 per week for each Tenant ie a minimum of $900 a week rental income from 3 distinct and separate income streams.

✓ Hence the investor will be receiving double the yield when compared to a standard/traditional investment property…. And so will provide the Investor with a substantial Cash Flow Positive income from their investment.

✓ This Co-Living model will offer investors the opportunity to invest in purpose built, designer homes that produce superior yields- but also importantly will provide excellent Capital Growth potential.

✓ Co-Living Tenants tend to be young single Professionals (for example Nurses and IT Professionals) in their 30’s looking for somewhere exceptional to rent (but at the same time affordable for them) – resulting in an average tenure of 4 – 5 years for each Tenant.

✓ Each Tenant will have a secured Bedroom with Keypad Entry with its own full Ensuite.✓Each Tenant will have their own secured Walk In Pantry within the kitchen.

✓ Each Co-Living Home comes with a complete and comprehensive up-market Furniture Package….including a TV in every Bedroom and Lounge.

✓ Unlike 75% of Rental Properties where the Landlord actually lives on site with the Tenant, in a Co-Living Property the Landlord is kept entirely separate from the property – making the Co-Living Property more attractive from a Tenant’s perspective.

✓ There is a full-time in-house Property Management Team to source and screen your Tenants – and manage the property on an ongoing basis for you.

✓ The Property itself can be sold on the open market to an Owner Occupier or indeed to another Investor happy to receive the elevated rental returns compared to a standard investment property.

EXAMPLE FLOORPLAN OF A CO-LIVING HOME

Co-Living House and Land Package

Co-Living Properties are House & Land Packages. So they are all purpose built from scratch with an anticipated construction time of 26 weeks (weather and circumstances permitting.)

Co-Living Homes will encompass 4 Bedrooms with Double Lock-up Garage and Back Garden.

There will be 3 Main Bedrooms (for each individual Tenant) + a Media Room which from a resale perspective will be the 4th Bedroom.

Each Co-Living Property will come with a fully comprehensive, upmarket Furniture Package which will include everything – even down to cutlery, TV’s and outdoor furniture.

Co-Living Properties will be available in Queensland, Victoria and New South Wales.

Price Entry Points will start from around $580,000 and go upwards from there depending on the Location and Land Cost.

Please contact Maurice Watson at The Property Investment Company for up-to-date Stock Availability and Price Listings etc.

Property Management and Sourcing Co-Living Tenants

Each Co-Living Property Development Group will have their own In-House Co-Living Property Management Team tasked with:-

A) Researching, sourcing and vetting your Co-Living Tenants.

B) The ongoing Property Management and Maintenance of your Co-Living Property.

Depending on the Co-Living Property Development Group selected, the annual Property Management Fee will range between 8% (+ GST) to 10% (plus GST.)

There will also be 1 x week’s rent payable for each Tenant sourced.

Leveraging Your Co-Living Property

For those investors wishing to 100% gear their Co-Living Investment Property, they will find themselves substantially Cash Flow Positive because they will be receiving double the income normally associated with a standard investment property.

Also, because inter-alia the property comes with a fully comprehensive, upmarket Furniture Package, there will be substantial Tax Deductions to be claimed…along with the usual fittings and fixtures and construction deductibles.

Because for all intents and purposes this is just a standard House & Land Package, any bank will be able to fund your Co-Living Property without any special conditions and requirements attached.

SMSF Investors

If you have a Self Managed Super Fund (or thinking of setting one up) a Co-Living Home with its elevated yields is certainly an attractive SMSF investment proposition

Capital Growth Expectations & Resale Parameters

Your Co-Living Property will appreciate in value in line with the growth of standard Owner Occupier Homes within its location and region.

In fact there is an argument to be put that a Co-Living Home could possibly increase more in value when compared to a standard home because of its attractive configuration of having 3 Separate Bathrooms – which is not the usual configuration for a standard property.

And from a resale perspective, you can on-sell your Co-Living Property on the open market to an Owner Occupier – for example a family with 2 children which will savour the attraction of having 3 Separate Bathrooms.

Or indeed you can on-sell to another Investor who will be attracted to the elevated Rental Returns when compared to a standard property.

FOR LATEST LISTINGS PLEASE CALL MAURICE WATSON ON 1800 770 114

All In One Fully Comprehensive One-Stop Property Investment Service

For our NSW, Interstate and Overseas clients we offer a fully comprehensive In-House Service to assist you with putting your whole Co-Living Investment Package together – either within a Family Trust, SMSF or within any other selected Purchasing Entity

Our services include:-

✓ Sourcing a Co-Living Property which will fit within your Comfort Zone and Price Entry Point.

✓ Sourcing suitable Co-Living Tenants via The Co-Living Developer’s Group dedicated In-House Co-Living Property Management Team.

✓ Funding via my In-House Specialist Mortgage Broker.

✓ Conveyancing using a recommended Solicitor fully conversant with Co-Living Contracts.

✓ Setting up a Family Trust (for an overall cost of $1990) to minimise tax payable on your rental income.

✓ A specialized Accountant to maximise your Co-Living Tax Deductions.

We find that these days most people are time poor so we offer a One Stop Investment Property Service. We do not charge any fees to put everything together for you and to monitor the processes – we get remunerated directly from the Developer/Vendor (not from you).

You are welcome to avail yourself of an obligation free holding deposit mechanism. For those clients wishing to secure a Co-Living Property without obligation all that is required is an EFT for $1,000 which is held in trust for you by the Vendor’s Solicitors (100% fully refundable if you do not proceed with your purchase for any reason).

Summation

So in summation, this type of property investment is cutting-edge, highly attractive with a definite point of difference – and is tailor-made to provide the investor with double the yield when compared with a traditional type of investment property.

It also provides Tenants with an affordable and commodious place to live in…So it is a “Win-Win” for both The Investor and The Tenant.

Please feel free to call me, Maurice Watson, on any of the numbers listed below if you would like to discuss this Co-Living Investment Opportunity in more detail and/or book in an informative One on One Zoom Meeting Conference with me.

Now is the time to purchase with interest rates still at historically low levels.

With banks typically offering only around 3% (or less) to Deposit Holders the Yield from a Co-Living Property is very appealing … combined with the potential for outstanding Capital Appreciation over time……Whereas in effect your money in real terms is actually depreciating in value whilst sitting in a bank account.

If this Co-Living Investment Opportunity is of interest, please respond back to us ASAP – since Co-Living Stock is strictly limited and is in great demand by Investors.